The economy is worrying senior Sarah Edwards about college.

“I may not get to go to the college I want because of the economy. College costs a lot, and my family can’t afford it,” Edwards said.

Sending a child away to college is a stress for many families, both because some parents don’t want their children to leave home and because college tuition has skyrocketed in recent years. At the University of Illinois at Urbana-Champaign, for example, tuition went up $718 from last year to this year, and it will go up again next year.

That’s the dilemma Edwards is facing. “[My parents] support me, but money is tight. I may end up having to go to Waubonsee for two years to save money,” Edwards said.

Edwards isn’t the only one. Many students realize that there’s more than just choosing a major and “dream” college—there’s also deciding which college they can afford.

Since the recession started in late 2008, an increasing number of Kaneland students have chosen to attend community colleges and trade schools. Among the Class of 2008, 17 percent attended local community college, Waubonsee. Just a year later, 27 percent of the Class of 2009 headed to Waubonsee, and in 2010, 33 percent also went. Among the Class of 2011, 46 percent went to Waubonsee too, while 44 percent headed to a four-year college.

It’s a sharp increase, but it’s in line with national averages. Nationwide, 40 percent of U.S. undergraduate students attend community colleges.

Community colleges like Waubonsee are becoming increasingly popular choices among budget-conscious students because they are less expensive than a four-year school in comparison. For example, tuition at Waubonsee is $2,352 a year, far less than tuition at a four-year public or private school.

Other reasons for their popularity is that students can live at home while attending, thus saving more money, and later transfer to a four-year school.

Senior Ray Barry plans to attend Waubonsee next year.

“It will give me an opportunity to save money and be able to live at home,” Barry said.

Counselors at Kaneland sometimes encourage students who are worried about costs or who are undecided about a major to consider two-year colleges.

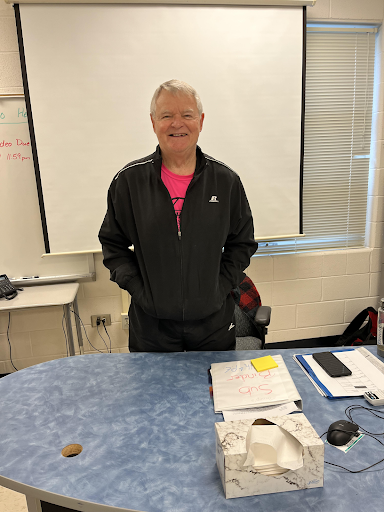

“You can take specific classes of an interest that you may have at a community college,” Counselor Andrew Franklin said.

Yet the sticker shock many students and families experience when looking at private college tuitions —where costs may be upwards of $30,000 or even $40,000 a year—may not always be reality. Many of these schools give out more scholarships than anywhere else, which reduces tuition costs into a very affordable price.

“Don’t neglect applying to private schools, because they can get the price close to what a state school would cost,” Franklin said.

Several members of the Class of 2011 won full-tuition scholarships to private universities, including Hannah Schuppner, who received a full ride to Northwestern University; Abby Michels, who received a full ride to Lewis University; and Jessica Corbett, who received a full ride to Ithaca College.

Private schools can also offer advantages that big state universities cannot—especially smaller class sizes. State universities like Northern Illinois and University of Illinois can have 20,000 or even 40,000 students, while many private schools are smaller.

That’s why senior Melissa Bohoroquez wants to go to Elmhurst College.

“I have more opportunity for hands on and teachers will know me as a individual” Bohorquez said.